Sunday, May 31, 2009

Up McDonald's, Down Starbucks

That and 25 cents (in those days) would get you on the subway. No big deal. (This sort of photographic memory would, however, come in handy tackling 2000-page texts in medical school.)

The above said, how on earth could I be interested in the stock of a company with a descriptive Web page titled Havin' Fun, when the heading of the page misspells Havin' as Havin? (Apostrophes count!)

Well, chalk it up to the decline of standards in this country.

More important than spelling is the buzz on the street.

Yesterday I was walking on a country street and talking with my friend, who is a restaurateur, about the investment merits of McDonald's (the "Havin' Fun" company). MCD's 1- and 2-year stock charts show no sign of the bear market, the stock yields 3 1/2%, the price-earnings ratio is reasonable, most sales are generated in foreign lands, and eating never goes out of style. Is that good enough to justify putting a lot of money in the stock? Not necessarily. As with Apple when it surged, a catalyst helps a lot. And it looks as though McDonald's has a catalyst to grow sales and earnings and to provide the very important theme to attract new investors.

As stated, I was pointing out that thinking in an old-fashioned way about actually marrying a stock rather than what has become the fool's game of trading (since the computers are smarter than you and less predictable), MCD, as a well-run growing company the fractional ownership of which yields more than cash and as much as a 10-year Treasury bond is interesting.

A voice interrupted from behind. A couple had been walking behind us and ventured to inform us that they had given up Starbucks' coffee for that of McDonald's. They said that McDonald's new line of espresso-based coffee drinks (McCafe) is superb. Not just good, but great. The local McDonald's, they said, is jammed full at 8 AM with espresso drinkers.

You should know that the specific part of America where we were strolling is isolated and upper crust enough that McDonald's is not a typical source of nutrition for the occasional fellow walker one may encounter from time to time.

That's good enough for me. In this modern industrial depression, luxury coffee remains affordable to many. "Mickey D" gives you a buzz, and is catching one. It is about as far from the Merchants of Debt as can be (until relatively recently, it did not even accept credit cards).

Buy and hold.

For the nonce.

Copyright (C) Long Lake LLC 2009

If Ben Stein is True to Form, It's Time to be Uber-Bullish

In the summer of 2007, Stein fils was aggressively bullish on the financial structure of the U. S.

How, he doubted in print, could a modest amount of subprime mortgages bring on a recession, much less the dire consequences predicted by such people as Nouriel Roubini?

Wrong!

Last week, Dr. Stein wrote a column titled: Decline and Fall: A View From 2089.

He foresees China looking back at the rapid decline and fall of the American economy as follows:

THE future is now. To see how history might look back on our economic crisis, we bring you this excerpt from “The Decline and Fall of the United States of America,” Beijing University Department of Western Hemisphere History (Beijing Press, 2089):

The demise of an economy as mighty as that of the United States as of 2000 cannot be accounted for by anything less than deeply mistaken and foolish decision-making within that nation’s ruling circles. . .

The Credit Collapse and the government’s conflicting response to it — shoring up the banks and expanding reserves on the one hand, while putting lending officials at risk for aggressive lending on the other — led to a prolonged slowdown in the economy.

At the same time, the confidence that American lenders had in the rule of law, probably one of the main pillars of the economy, was demolished by government actions that invalidated some lenders’ long-held legal rights in favor of ad hoc attempts to please various political constituencies. . .

By 2012, after a substantial victory by President Obama over Jeb Bush of Florida, brother of George W. Bush, the United States had been mired in recession for six years. (The Obama victory was greatly aided by the unopposed secession of Texas and Alaska from the nation. . .

By 2014, the federal government’s debt had reached $25 trillion, while the economy had shrunk to roughly $10 trillion in annual output (at 2006 prices). At that point, the Treasury began to announce that it would suspend payment of interest to foreigners on United States federal debt except by the issuance of so-called P.I.K., or payment-in-kind, notes of the Treasury. These were simply payments by promises instead of by money.

At that point, only the Federal Reserve remained as a buyer of United States Treasury debt. Foreign holders sold as quickly as they could. The dollar collapsed, and the yuan replaced it as a global reserve currency. The resulting hyperinflation in the United States and the accompanying collapse of the republic are by now known to every schoolchild. ...

DoctoRx here.

Barack Obama needs to worry when Ben Stein predicts his re-election! (And he will not face Jeb Bush. Jeb does not want the job, and the American people will not soon hanker for yet another Bush family President.) Mr. Obama also need not fear Texas and Alaska seceding; and if they do, such a move will hardly be unopposed. Even a "green" President knows we need oil.

From a markets perspective, let us simply point out that nine years ago, there was triumphalism in America. Nine years from now, there may be triumphalism again; or in perhaps nineteen years.

I for one do not buy the idea of quick Chinese supremacy or the idea of a straight-line decline and fall of America. The Brits retain a large, prosperous economy despite decades of economic mismanagement after WW II, and mismanagement again recently, and despite loss of the pound sterling's status as the world's reserve currency. America has been perhaps the kindest, gentlest imperial power in history. Only barbarians such as al-Qaedans have their knives sharpened for us. That fact should limit the downside risks to the expected relative decline of America as an economic power, as other countries grow faster from a poorer baseline.

A large and powerful hurricane is passing through the U. S. economy. Fraud and incompetence have allowed much more damage to be caused than was necessary. (The analogy is incomplete, as this hurricane was man-made, not a natural phenomenon.) Ben Stein did not recognize the outer rain bands as being portents of anything more than a summer shower. Almost a full two years after the outer rain bands arrived, he is extrapolating further disaster, such as a Katrina-like flood occurring after the storm passes, and worse than that.

One final analogy: After the economic and political disasters of 1973-4: OPEC's rise, Nixon's fall, and the humiliation in VietNam, the stock market and economy rose sharply for two years, then the stock market fell sharply adjusted for inflation from 1977-82 as the economy gyrated. Similar things happened in the 1930s-40s. More pain is probably coming, but the parts of the economy that were not dependent on easy credit have the high ground and should be spared even if the passing storm causes more flooding.

Copyright (C) Long Lake LLC 2009

Haiku of the Day

Causes multiple pile-ups.

Pays off the cops

Copyright (C) Long Lake LLC 2009

Saturday, May 30, 2009

California's Finance Director Says That It Provides Almost No Services to Most of Its People

Mr. Schwarzenegger, a Republican, is threatening to eliminate the Healthy Family Program, the state’s health insurance program that covers over 900,000 children and is financed with state and federal money, as well as the state’s main welfare program, known as Cal-Works, which provides temporary financial assistance to poor families and a caregiver for the severely disabled. (Ed: Medicaid, for the poorest people, would be unaffected.)

The $1 billion in cuts to programs for the poor would be met with $680 million in new cuts to education and a 5 percent salary reduction for state employees, many of whom are already enduring furloughs.

As the article makes clear, the reality is that:

“Government doesn’t provide services to rich people,” Mike Genest, the state’s finance director, said on a conference call with reporters on Friday. “It doesn’t even really provide services to the middle class.” He added: “You have to cut where the money is (Ed: where it is going, he means).”

So we now know that voters of one of the most reliably blue states has voted its pocketbook. And the state takes it lying down after spewing its own purple prose before the vote:

In less than two weeks, the administration has gone from warning residents that a vote against the budget measures would send the state — some $24 billion in the red — into utter turmoil to sanguine acceptance that “the people have spoken” and that the government must move on.

In fact, it has been reported that if the powers-that-be want to avoid cuts, the state can borrow huge amounts of short-term money, such as for one year, but the rate would be on the order of 3%. (Not so terrible!)

The article concludes:

The Democratic-controlled Legislature has been uncharacteristically silent on most of the cuts, most likely because lawmakers know that tax increases are not politically palatable, that huge cuts in some form are in the offing no matter what, and that any program they wish to spare will quite likely have advocates among their ranks.

“There is no drawing lines in the sand,” said Alicia Trost, the spokeswoman for State Senator Darrell Steinberg, a Democrat and president pro tem. “Everyone knows we’re the majority, and we all know where we stand.”

Where California voters stand is with their heads finally out of the sand and facing reality. Among the reality is of overpaid public officials, as per another NYT article, Industry Fears U.S. May Quit New Car Habit, which describes a prior great new car customer as follows:

The housing and financial crisis has taken its toll on reliable customers like Frank Powell, a school administrator in the East Palo Alto school district in California. He moved out of the house he had lived in since 1983 and started renting a few months ago because of his debt burden, which includes auto loans.

“I used to buy cars all the time and took out loans to pay them off,” he said. “As soon as I paid part of one off I’d get another. I’d buy one for my kids, my wife, myself. I can’t do that anymore.”

He now has a Cadillac Escalade sport-utility vehicle, but he is thinking about downsizing and driving something much smaller — and for longer.

“Something had to change,” he added. “You just can’t keep going with that many cars.”

How did a school administrator get all the money to raise a family and spend tons of money on new car after new car for the whole family, including a Cadillac now? Did he perhaps get paid a bit more than was necessary to incentive him to get up in the morning and go to work? Yours truly was a well-compensated practicing physician and never drove anything more upscale than a Mercury until near retirement.

As Mr. Powell said, something- nay, much- has to change in California.

A start would be for the Mr. Powells of the future to buy small cars or take public transit, to buy as few cars as possible, and to pay for these cars largely or entirely with cash, thus avoiding exorbitant finance charges and helping to keep their financial net worth positive. And what goes for a car goes double for a house. They should buy the least, not the most, house they can afford- as did my parents and those of my wife- and pay off the mortgage as rapidly as possible.

The future Mr. Powells need to ignore the Merchants of Debt who likely upsold him and tens of millions of Americans and begin their own Ownership Society, not the fake "Ownership Society" of the prior President that was based on debt and more debt.

With this sea change toward frugality and balanced state and personal budgets, California can once again lead America to a prosperous future.

Copyright (C) Long Lake LLC 2009

Friday, May 29, 2009

It Shrinks?

Elaine: What do you mean like laundry?

Jerry: No, like when a man goes swimming afterwards.

Elaine: It shrinks?

Jerry: Like a frightened turtle!

Elaine: Why does it shrink?

George Costanza: It just does.

Elaine: I don't know how you guys walk around with those things.

George Costanza: I was in the pool! I WAS IN THE POOL!

("Seinfeld", 1994, The Hamptons)

OK. Enough with Seinfeld. What's the point of the reference?

It's the Fed. And it's the economy. And it's deflationary.

What's the problem?

Not enough private loan demand, as demonstrated in A Look Inside Fed’s Balance Sheet — 5/28/09 Update:

The Fed’s balance sheet shrunk in the latest week to $2.064 trillion from $2.165 trillion. While the central bank boosted its holdings of Treasurys and federal agency debt, the increases were more than offset by declines in direct bank lending and liquidity swaps with foreign central banks. The TALF and commercial paper facilities also shrunk in the latest week. (Emph. added. And would any English majors agree that the WSJ meant "shrank" rather than "shrunk"?)

Copyright (C) Long Lake LLC 2009

Times Are Tough, Even in Beverly Hills: 60% Off to See the Prez

Aides said the Democratic National Committee will net more than $3 million from the night's events, even though some ticket prices were slashed to $1,000 from $2,500 when initial sales were slow.

Thus proving that deflation is alive and well.

Copyright (C) Long Lake LLC 2009

They Really Said It

Obama's Historic Pick Pricks Conservatives

Really!?!

Copyright (C) Long Lake LLC 2009

Not Content With Ruining the Western and Japanese Economies, the U. S. is Working on Ruining China's as Well

The (Chinese) government has compelled state-run banks to unleash a flood of credit, lending more in the first four months of this year than in all of 2008. And officials have announced a series of subsidies and other measures to encourage rural dwellers to splurge on such items as small-engine cars, home appliances and electronics.

The article makes clear that Treasury Sec'y Geithner, who visits China this weekend, is going to urge China to be more like us and borrow and spend more while saving less.

Because we've done so well having unleashed a flood of credit upon ourselves and splurging on stuff.

Copyright (C) Long Lake LLC 2009

Thursday, May 28, 2009

From Berkshire Hathaway: Think Emergency Room, not Green Shoots; and Other Reports the Green Shooters Would Prefer You Not Know About

First, from Bloomberg.com, Japan’s Factory Output Surges 5.2% as Recession Eases (Update1). Beyond the info contained in the title, here's the most newsworthy part of the article:

Still, even as overseas shipments start to rise on a month-on-month basis, Japan is exporting a little more than half as much as last year and producing about a third less. That has saddled manufacturers with factories and workers they no longer need.

Nippon Steel Corp., the country’s biggest mill, is running at half capacity . . .

Next, courtesy of Calculated Risk's notice, ATA Truck Tonnage Index Fell Another 2.2 Percent in April:

ATA Chief Economist Bob Costello said truck tonnage is getting hit from both the recession and the massive inventory correction that the supply chain is currently undergoing. "While most key economic indicators are decreasing at a slower rate, the year-over-year contractions in truck tonnage accelerated because businesses are right-sizing their inventories, which means fewer truck shipments," Costello said. "The absolute dollar value of inventories has fallen, but sales have decreased as much or more, which means that inventories are still too high for the current level of sales. Until this correction is complete, freight will be tough for motor carriers." Costello added that truck freight has yet to hit bottom and it could be a few more months before this occurs. (Emph. added)

Third, from the head of Berkshire Hathaway's Mid-American Energy and HomeServices of America subsidiaries, also courtesy CR's attention, MidAmerican's Sokol sees US housing staying weak:

"As we look at the economy, I have to be honest: we're not seeing the green shoots," Sokol said . . ." (Emph added)

"We think the official statistics of 10 to 12 months' backlog is actually nearly twice that amount . . ."

"There is an enormous shadow backlog of about-to-be foreclosed homes and of individuals who need to sell but have time, and there are already six (for sale) signs on their block," he said.

Assuming the economy does not worsen, he said: "It will be be mid-2011 before we see a balancing of the existing home sales market." He defined "balanced" as a six-month backlog.

Fourth, courtesy of Mish, consider "Mr. Mortgage", who had extensive comments today on the jump up in mortgage rates due to the bear market in Treasuries, in Potential Consequences of 5.5% Mortgage Rates:

With respect to yesterday’s in the mortgage market — yes, it is as bad as you can imagine. No call can be made on the near-term, however, until we see where this settles out over the next week of so. If rates do stay in the mid 5%’s, the mortgage and housing market will encounter a sizable stumble. . .

The consequences of 5.5% rates are enormous. Because of capacity issues and the long time line to actually fund a loan in this market, very few borrowers ever got the 4.25% to 4.75% perceived to be the prevailing rate range for everyone. . .

A significant percentage of loan applications (refis particularly) in the pipeline are submitted to the lenders without a rate lock. . . Therefore, millions of refi applications presently in the pipeline, on which lenders already spent a considerably amount of time and money processing, will never fund.

DoctoRx here again. Those readers who know me know that I'm generally a cheerful guy and an optimist. I was once also in the non-fiction business of treating patients who may have had illnesses and who when ill were not guaranteed to get better no matter how hard I and the rest of the medical team tried and how much cardiac stimulus or chemo we applied. The same is true of the stock market and may be true of the economy if the doctors of the economy apply the wrong treatment, even if it is thought to be the right stuff at the time. To go back to Mr. Sokol from Berkshire Hathaway:

It took us 11 years to get into this mess where it is. (Ed. That refers to housing specifically.) We went into the emergency room last fall and by January the banking system and economy generally were in intensive care, and we'd expect it to stay there for some time," Sokol said.

How much do you trust the medical teams attending the sick, bleeding U. S. and global economies?

Copyright (C) Long Lake LLC 2009

The Market Gambles as P&G Stock Rises on Bad News

. . P&G said it expects earnings of $3.65 to $3.80 per share for fiscal 2010, which starts in July, and net sales ranging from down 2 percent to up 1 percent.

Analysts on average expected fiscal 2010 earnings of $3.92 per share, according to Reuters Estimates.

BMO Capital Markets analyst Connie Maneaty recommended buying P&G shares on any weakness resulting from the outlook as she sees the company's fundamentals improving over the next year.

"We expected P&G to offer an outlook that pointed to heavy investment to recoup share losses, especially in detergents, and accelerate the investment in faster-growth international markets," Maneaty wrote in a note to clients. "We believe today's news represents a solid buy-point."

P&G stock was already up 20% from its low. It now sells for about 14X year-ahead earnings with no sales growth projected. It has immense gross margins and could cut prices as much as it wants, but its mantra is inflation. It has a large negative net working capital position and a larger negative tangible net worth. Yet the stock is up a bit as the cheerleaders in the financial community tell the public that all was priced in. "PG" will clean up in China, we are supposed to believe (that's a pun on "clean").

In a rational market, one that is evenly poised between optimism and pessimism, news of this sort from a supposedly recession-resistant company should bring out sellers.

3 months ago, consensus earnings estimates for PG for the current fiscal year were $4.26; now they are $4.23. Far worse by normal yardsticks, the next-year's earnings estimates for the next year were $4.11, and now they are lower by a massive 10% or so. A steady Eddie company such as P&G just does not do this.

Worse, PG is a dividend stock. While the payout was increased 10%, competing yields from safety-conscious come from Treasuries, which have increased their payout far more.

Other evidence of strange market behavior comes from the near-doubling of oil prices in the last several months being greeted as good news. The collapse in oil prices was the only truly good thing that came out of the economic collapse. The rapid rise in oil prices, which consumers have noted when buying gasoline, is horrible news for a fragile U. S., Western and Japanese economic structure.

Let's be optimistic, but realistic. The stock market is a bit more optimistic than I like.

Time will tell.

Copyright (C) Long Lake LLC 2009

Wednesday, May 27, 2009

Economic Banana More or Less Confirmed as Depression

U.S. manufacturing output is expected to decline 12% this year, a much sharper pullback than the 8% predicted just three months ago and a sign of how the downturn is hitting factories particularly hard, according to a new report.

"Everything has gone to rock-bottom levels that I thought was unattainable," said Daniel Meckstroth, chief economist at the Manufacturers Alliance/MAPI, a public-policy group in Arlington, Va., that published the report.

This downward revision is late coming. As the Government has been reporting and this blog has been one of the few noting in print, wholesale trade figures are closer to a 20% year on year ("yoy") decline, and the dollar volume of this trade is enormous, around one trillion dollars monthly. It is pretty much the whole economy minus such personal services as legal fees, haircuts, etc.

If the conventional differentiation between a recession and a depression is a 10% drop in output, then a manufacturing depression is essentially confirmed. It is not the Great Depression, but if one considers all the outsourced manufacturing to Asia and look at Asia's truly enormous manufacturing/export declines, it is not so clear that this event and the 1929-32 events are all that different. Of course, there is much greater material wealth now, and non-cyclical endeavors such as health care are a much greater part of the economy now. With retail down about 10% yoy, though, I'm inclined to call this downturn a Depression.

Unlike the mid-1970s near-Depression that was caused by an oil embargo and quadrupling of oil prices, or the severe but less severe 1981-2 recession that was deliberately caused by Paul Volcker using very high interest rates and slow money supply growth, this downturn was self-inflicted but not deliberately so and is thus closer to the 1929-32 crash than the more recent severe economic downturns.

Depressions end; this one may soon end, but Depressions are like major hurricanes or earthquakes. Each is its own event. This one is/was a Katrina, hitting our major industries of finance and auto manufacturing with devastating force. Simply knowing that Katrina was passing, or even that the flooding had peaked, did not change the devastation that was wrought on New Orleans.

Live, and invest, accordingly.

Copyright (C) Long Lake LLC 2009

Wednesday Afternoon Market Update: Focus on Gold and Treasuries

Spot gold itself is up 30% since its low of half a year ago at $720/oz. It has also potentially failed against the double top of last July and this February. This may be a bullish portent for Treasuries. The inflation-deflation adjusted (i.e. real) yield on Treasuries is as high as almost any yield that existed during tightening periods in the Volcker/Greenspan eras.

What may be happening in Treasuries and in the economy happened in the Great Depression. Let me refer you to Paul Lamont, a financial historian who has made some marvelous calls this cycle. On Jan. 5 of this year he published on the Web "The Haughty Bond", which pointed out:

The investment herd is currently engaged in a Bond buying frenzy. They believe that inflation will be low for an extended period. We agree. While we may have inflationary countertrend rises, overall we are in a deflationary environment where banks fail, assets fall and the economy deleverages. However as history shows, government bonds were sold in the deflationary spiral of 1930-32. The excuses were two fold: liquidity concerns and inflation fears. Banks sold bonds (their mortgages were frozen) to raise cash reserves in case depositors decided to withdraw funds. In addition, major government interventions at the time (sound familiar?) caused a fear of long term inflation. The dumping of Treasury Bonds finally stopped in June of 1932 (the same month as the stock market bottomed). So Bonds depreciated in the historic deflation of the early 1930’s, but is this relevant today?

The current bull market in Bonds has lasted since 1980. But only recently has the Treasury Bond market registered a record extreme in bullish consensus according to MBH Commodities' Daily Sentiment Index. Now for the first time in 28 years, 99% of traders believe the upward trend will continue. Remember when everyone thought real estate could only go up in value? At this point, the Treasury Bond market is swaggering around, certain of its own opinion that it cannot fall.

In this scenario, mortgage-backeds should be sold aggressively, as they have been far to strong vs. Treasuries, or held to term. Now that there has been an historic steepening of the Treasury yield curve with an equally historic percentage increase in yields of 85% (from 2 to 3.7%) in about 5 months in the 10 year T-bond, Lamont's analysis suggests that one can now buy intermediate to long-term Treasuries either to hold for the long term or to trade out of on price strength. This was the right strategy during the Great Depression until WW II inflation hit and remains a potentially potent risk-reward strategy for an appropriate portion of a portfolio today.

Copyright (C) Long Lake LLC 2009

What Does the Mafia have to do with the Debt Crisis?

Unlike overleveraged companies burned in the credit crisis, the Mafia and its cash-based, debt-free business model are breezing through economic hard times. With young, savvy leaders at the helm, organized crime is poised to expand as legitimate companies founder.

The motto of this blog is "In equity, veritas". The word "equity" has a double meaning. Relevant to the current topic is the meaning of ownership (cash) rather than debt. What the lengthy Bloomberg article demonstrates is that Godfather Part III is happening today. You can be sure that this phenomenon is not limited to Italy.

The Mafia has been thrifty. The Corleone family lived below their means. This "debt-free business model" is one that used to be the American ideal. It is not too late for America and the large swaths of the world that have followed our lead to turn their backs on the Merchants of Debt and go back to where they once belonged.

Copyright (C) Long Lake LLC 2009

Human Sacrifice Before the Altar of Big Finance

On Jan. 6, I posted Land of the Setting Sun, which began: "We are Japan."

Matters are going from bad to worse regarding the cause of the current economic problems, Big Finance. Please stick with this post, which grew from a planned brief one into something longer, due to breaking news.

Along that unfortunate theme of chronic depression or near-depression in real estate and other markets, yesterday I posted, Everybody Knows That Housing is Bottoming, Right? Today (Tuesday) there is some new commentary and news worth reviewing. First, the Case-Shiller house price data for March came out, per Calculated Risk:

The Composite 20 index is off 31.4% from the peak, and off 2.2% in March.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices. (Emph. added. CR is superb on real estate; what he predicts quite generally happens.)

The Composite 10 is off 18.6% over the last year.

The Composite 20 is off 18.7% over the last year.

OK, so this is "backward looking". Let's look forward toward the coming housing and economic recovery, which the global stock markets are ebulliently doing, per the San Francisco Examiner, also courtesy of CR: Signs of more trouble ahead for housing market. Excerpts include:

Warren Buffett and Alan Greenspan say the housing market is near bottom.

Peppy real estate agents and gloomy stock-market traders alike eagerly embrace that supposition. Wall Street is so hungry for good news that stocks rallied at the barest hint of upbeat indicators several times this month.

But an array of serious pending issues undercuts the turnaround theorists. . .

Here is a rundown of key problems that could continue to undercut real estate.

Demand still softens

-- Rising unemployment.

- - No "move-up" buyers.

-- Tight credit. (Ed.: Actually, back to normal old-fashioned credit, such as requiring 20% down. In the Great Depression, 50% down was standard, and cash purchases were common.)

-- Homes still overpriced.

Supply likely to surge

-- Foreclosure moratoriums end.

-- Shadow inventory.

-- Walk-away underwater homeowners. (This section is a "must-read". The couple referenced may elicit mixed reactions in you.)

-- Loan modification shortfalls.

-- Option ARM, Alt-A time bombs.

-- High end taking a hit. "The mid- to upper-end housing market is sitting on the exact precipice that the lower-end market was sitting on in early 2008 . . ."

OK. The article is worth a read, but who can stand more and more of the same old bad stuff. Time for good banking news, per Bloomberg: JPMorgan’s WaMu Windfall Turns Bad Loans Into Income.

JPMorgan Chase & Co. stands to reap a $29 billion windfall thanks to an accounting rule that lets the second-biggest U.S. bank transform bad loans it purchased from Washington Mutual Inc. into income. . . (Emph. added)

“It (the accounting rule) will benefit these guys (many banks) dramatically,” Willens said. “There’s a great chance they’ll be able to record very substantial gains going forward.”

The discounted assets purchased by JPMorgan and Wells Fargo make the stocks more attractive because they will spur an acceleration in profit growth, said Chris Armbruster, an analyst at Al Frank Asset Management Inc. in Laguna Beach, California.

“There’s definitely going to be some marks that were taken that were too extreme,” said Armbruster, whose firm oversees about $375 million. “It gives them a huge cushion or buffer to smooth out earnings.”

Let's translate. Banks that went bust, more or less, were taken over by politically-favored bank holding companies (BHCs). These BHCs were bailed out and are scheduled to have all the bad assets they want removed from their possession at unrealistically high prices with more massive taxpayer subsidies (via PPIP, see below). Now in a cynical sleight of hand, these same politically favored BHCs are scheduled to meet Wall Street's demanding standards for "acceleration in profit growth" or less demanding standards to "smooth out" alleged earnings simply because they undervalued the assets they purchased. NO economic earnings will have been created via this "accounting rule".

Like magic, the same guys who caused this global disaster are going to be able to pretend to be managers of growth stocks. Yet in the real world, there is no real recovery in residential housing, and commercial real estate, which is typically a late-cycle actor, is imploding, with NYC sublets down up to 67%.

Even at this hour, the news is coming fast and furious. Once again courtesy of CR, I see while writing this that the WSJ is reporting: Banks Aiming to Play Both Sides of Coin:

... Banking trade groups are lobbying the Federal Deposit Insurance Corp. for permission to bid on the same assets that the banks would put up for sale as part of the government's Public Private Investment Program....

The lobbying push is aimed at the Legacy Loans Program, which will use about half of the government's overall PPIP infusion to facilitate the sale of whole loans such as residential and commercial mortgages.Federal officials haven't specified whether banks will be allowed to both buy and sell loans ...

Some critics see the proposal as an example of banks trying to profit through financial engineering at taxpayer expense, because the government would subsidize the asset purchases...."

The notion of banks doing this is incongruent with the original purpose of the PPIP and wrought with major conflicts," said Thomas Priore, president of ICP Capital, a New York fixed-income investment firm overseeing about $16 billion in assets.

Mr. Priore is being polite. The entire purpose of PPIP was to corruptly recapitalize the banks using, inter alia, the fiction that hundreds of billions of dollars of inventory that they own as assets/capital are suddenly "illiquid" rather than the truth that these assets have lost vast amounts of value that the BHCs and Mr. Obama (like Mr. Bush before him) don't wish to admit. That the BHCs want in on both sides PPIP proves the fact that the financial community wins coming and going from PPIP. The taxpayer loses. Period. Abe Lincoln would turn over in his grave. Government of, by and for the bank holding companies.

This is beyond revolting. The idea that Barack Obama is a populist is absurd. For the banks to even lobby for this concept shows how in control they are. The President has surrounded himself with hedge fund types such as Larry Summers. Tim ("triumph of the will") Geithner is such an incompetent tool that the WaPo has dumped big time on him, and his staff has gone over his head to the White House.

The economy, and more than the economy, of the United States are being sacrificed upon the altar of Big Finance, using voodoo economics and the Big Lie technique. A bleeding country cries out for relief.

Copyright (C) Long Lake LLC 2009

Tuesday, May 26, 2009

Everyone Knows that Housing is Bottoming, Right?

Housing Hitting Bottom by June Means Fewest Starts Since 1945 (Bloomberg headline, no article published yet to link to)

and, courtesy of Calculated Risk, a WaPo article titled Housing Bust Leaves Most Sellers at a Loss;

Local Prices Expected to Continue Falling:

In the Virginia and Maryland suburbs, prices for single-family homes are down to where they were five years ago. In Prince William and Loudoun counties, a flood of foreclosures has pushed prices so low that bargain hunters have flocked there in recent months, helping to boost sales.

But while in past slumps a surge in sales has signaled the start of a rebound, this downturn is unlike any in recent times and it's premature to call a recovery, said Barry Merchant, senior housing policy analyst at the Virginia Housing Development Authority.

The encouraging signs have been offset by more troublesome ones, he said. After tapering off for a few months, foreclosures in Northern Virginia are starting to creep up again and may keep climbing now that several lenders have lifted foreclosure moratoriums.

Meanwhile, the year-over-year sales increases of the past few months are petering out in some Virginia suburbs, suggesting that interest in the fire-sale prices may have peaked, Merchant said. In April, Loudoun sales declined 12.5 percent from a year earlier.

"If sales are not increasing and foreclosures are on the uptick, then the question is: 'Is there another shoe to fall?' " Merchant said. "Maybe what we were hoping was the bottom was just a bump on the way down." (emph. added)

That there are fewest housing starts since the war year of 1945 is hard to wrap one's mind around. The imbalance in the economy that led to this is almost incomprehensible. Even the current low level of housing activity and current pricing are being propped up by gigantic, unfunded Federal programs. The crash would be worse absent these artifical stopgaps.

Heavens forfend, but what could be happening in this house of cards (no pun intended) is that all the market manipulation/intervention from the bankrupt in all-but-name Fannie/Freddie will be for naught, and that after a spasm of bargain-hunting, the housing market will continue sinking, as the article above suggests could already be happening.

From an asset allocation standpoint, history has shown any economic sector that undergoes a full-fledged bubble, not just a bull market, sits out the next up-cycle in the economy. This was true for gold after it bubbled into January 1980, after which it lost close to 90% of its value till its bottom around $250/ounce. This was true of Japan, which after a 19-year bear market did about as poorly as the Great Crash of 1929-32/3 did in 3-4 years. This was true of the NASDAQ bubble of 1995-2000, which bottomed in 2002 but adjusted for inflation dropped to a new low in the recent bear market of 2007-9. All the above paid zero or close to zero in dividends.

The housing market is unique from an investment standpoint in that a home is a fantastically expensive investment. The message here is simple. Residential real estate is likely to be for years to come nothing more than a place to live that should be treated as an expense. Investments for profit will be better in the financial markets. Inflation hedges involve gold, industrial materials, and foreign currencies, but not residential real estate. Its time will come again, but not soon.

Copyright (C) Long Lake LLC 2009

Sunday, May 24, 2009

Memorial Day Factoid and Comments

Sunday Forum: They died for you

Author RICK ATKINSON tells us 10 things Americans should know about World War II

The United States built 3.5 million private cars in 1941; for the rest of the war, we built 139. Instead, in 1943 alone, we built 86,000 planes, 45,000 tanks and 648,000 trucks.

DoctoRx here.

Comparing WWII conditions to today, there is now immense gnashing of teeth over the "depressed" new car sales pace of somewhat over 9 million vehicles yearly. The population is about 2 1/2 times that of 1941. The current depressed sales pace is more than 2.5 times the vehicle production pace of 3.5 million in 1941. So, where's the "Depression" in new car sales? In addition, there are vastly more existing vehicles already carrying people and things around now, and they last much longer than they used to. So, there should be less need now for new cars, not more.

If the country could survive building no passenger cars for almost 4 years back then, it can survive at a 9 million build pace now. And if society is serious about decreasing fuel use, the fewer new cars, the better.

The powers that be, which currently are the Democrats, have a problem. There is no war to absorb millions of the unemployed. Fixing potholes can go on only so long. Health care is already a large part of the economy, and the President opined yesterday on C-SPAN that health spending needs to be reined in, not increased.

Perhaps what America needs is a time out, a slowdown, a rest. Economic output for its own sake is a false God. Perhaps more time with friends, family and even alone would be better for the country than the obsession with "the economy".

The automakers for years have sold more vehicles than people could afford. They became finance companies first and manufacturers second. Thus the popularity of leasing. Thus the Ditech subprime subsidiary of GM's GMAC subsidiary. And so on. They were called the Big Three, but they were more part of Big Finance than the manufacturing sector. (And similar things were true of Caterpillar, John Deere and increasingly IBM. And GE has been a finance company first and other things second for many years.)

The past year or so has witnessed the essentially complete collapse of the American private financial structure. As we reflect upon the efforts and sacrifices of those who served the U. S. military tomorrow, we may question why the current and prior administrations have asked immense sacrifice from American taxpayers to keep the "system" going but have asked no sacrifice from those who lent massive amounts of money to the holding companies that happen to own a bank. None.

If the main purpose of the Presidency, Congress and the Federal Reserve is to spend whatever it takes to make bondholders whole while the nation groans, then this is no longer a government of and for the people.

America needs to get back to basics. As Yves Smith of Naked Capitalism has said, when it comes to helping Big Finance, Team Obama believes in the Big Lie. Basically, the Big Lie is that the "legacy assets" that Big Finance owns are "illiquid".

The truth is that whatever assets Big Finance owns are worth what their market price is, and they are not illiquid; Big Finance just hates the market price. If potential buyers of the securities won't pay what Big Finance thinks they are worth, then the public has no dog in that price dispute. Yet the President insists that the Public Private Investment Partnership (PPIP) must go forward, further risking an already actuarially insolvent FDIC, providing large taxpayer subsidies to Mr. Obama's main economic advisor Larry Summers' former employers in hedge funds as well as to Big Finance. After this disgraceful sham happens, the greatest looting operation perhaps in history will be more or less complete.

Being inherently cyclical, the economy will rebound and still responsive to money-printing, the current Depression having been caused by the many frauds from the housing-finance community and the Government-approved excessive leverage used by Big Finance. The looters and their enablers in government will claim victory, and the Potemkin economy based on transferring money from savers and borrowers into the pockets of the Big Financiers will have been saved from a fate worse than (name it) by you and me.

Have a happy Memorial Day.

Copyright (C) Long Lake LLC 2009

Fed Defends Its Mistakes

Speaking in Princeton, Fed Vice Chairman Donald Kohn said in a speech that:

“The preliminary evidence suggests that our program so far has worked . . .”

He insists that all the money-printing will boost the economy. As reported in Bloomberg.com,

Purchases may increase nominal gross domestic product as much as $1 trillion “over the next several years,” Kohn said in a footnote to his remarks.

Other Fed interventions to aid bond dealers, mutual funds and credit markets also “have been successful in supporting economic growth” by lowering rates and “preventing fire sales of assets,” Kohn said.

The Fed did not see this catastrophe coming. It did not regulate its banks well. The Fed's bailout of Bear, Stearns (and therefore probably of JPMorgan Chase) has caused it substantial losses, as has its AIG bailout. The New York Fed exists for the benefit of its member banks, not the public or even the Federal Government, and the New York Fed under Tim Geithner ran the show. Mr. Geithner continues to do everything he can to favor the banks. (See: Geithner Adopts Part of Wall Street Derivatives Plan (Update1.)

The Fed has no charter to prevent "fire sales" of assets. Consenting adults are allowed to trade securities freely. The Fed has made a serious mistake in buying MBS.

First, the economy has become internationally non-competitive. In order to compete successfully, preferably without relying on military superpower status to cow the rest of the world into submitting to our terms, the country needs to cease its wild and crazy love affair with housing and direct more effort toward exports (or else expect a permanent diminution in imports both of oil and of finished consumer products).

Second, the quality of the MBS the Fed is purchasing is suspect, and more important, the price is even more suspect. A "fire sale" is a ridiculous term. The securities are worth the price at which a willing buyer and a willing seller will exchange ownership. The Fed has no role in its charter to print money to pay above market prices in order to own pools of mortgages. If it prevented a fire sale, it therefore overpaid.

Let us now come back to Dr. Kohn's comments that all this buying of MBS will probably boost

nominal GDP a great deal.

"Nominal" means without reference to the effects of inflation.

Is he predicting inflation, or is he predicting real growth? Not that he will say . . .

With regard to Dr. Kohn, Mish today has a lengthy post that examines various comments of Dr. Kohn and of the Fed in general, and this is well worth a read. See Fed's Vice Chairman Admits Fed Has No Exit Strategy both for information about the Fed's asset quality (referred to above in this post) and for cogent commentary.

Copyright (C) Long Lake LLC

Saturday, May 23, 2009

The L. A. Times Deigns to Differ . . .

. . . eliminating as much as $24 billion from the proposed $95.5-billion general-fund portion of the 2009-10 state budget would further corrode an economy already creaking under the weight of a national recession.

The above sentence was presented as fact. It was not a quote expressing some expert's opinion.

Yet it is in fact an opinion. This article, printed in the business section, is an editorial in disguise. More disguised editorializing masquerading as reportage:

Distressed car dealers could see sales to state agencies shrink, printing shops may lose business as courts and other government operations shorten their workweek, and office-equipment suppliers would lose sales as cash-strapped agencies make do with aging copiers.

And cutting as many as 5,000 state jobs, and perhaps thousands more as budget reductions cascade down to schools and local governments, would hit especially hard in a state that already has the fifth-highest unemployment rate in the nation.

Sorry about the loss of state jobs. (Where are the regrets in the piece about the loss of zillions of private sector jobs?) It's just that the employers of these employees, namely the taxpayers of California (and soon the taxpayers of all 50 states?) can't afford these employees. Are you, gentle reader, wiping the tears from your eyes because state agencies must make do with used copy machines?

(Why is anybody copying much of anything anymore, anyway?)

More scare tactics reported as fact, not opinion:

Promising students would go to other states, taking their future skills, earnings and, possibly, Nobel Prizes elsewhere.

Talk about purple prose. All because California voters rejected a set of gimmicky propositions, such as gambling on future lottery revenues to pay for current spending. Gimme a break! Back to the article:

Businesses have long complained about big-spending government in California. But with state and local spending accounting for about one-fifth of the state's gross domestic product, California is in line with some other heavily populated, expensive-to-manage states, such as New York and Florida.

The way competition between states works is that better-run states, as with better-run companies, gain market share. Yours truly is a Florida resident. While I love California climate and physical attributes as well as many of the attitudes of Californians, from a "business of government" standpoint, there is no comparison between the states. Despite suffering just as bad a real estate bust as California, the state of Florida maintains a triple-A credit rating. Florida was one of a handful of states, and the only "housing bust" state, to have gained jobs last month. Not to get overly political, but Florida is in its 3rd straight term with a Republican governor and has for some years had an all-Republican legislature. Unlike D.C. Republicans, these guys cannot print money, and they actually have acted like the prior image Republicans had. They kept government small and did not get carried away with grandiose projects as did the Gubernator.

So much for the whining and for the implication by the Times that California is really well-run, it's just that the voters are too cheap or stupid to vote for the funding the state needs.

Back to the L. A. Times article, which ends by quoting someone the reader is supposed to assume is impartial:

"Government is supposed to be a stabilizing influence, and instead they're becoming part of the problem," said Christopher Thornberg of Beacon Economics. "They should be spending when everyone else is cutting back. They should be buying cars when no one else is buying cars."

Here is information taken directly from the Beacon Economics website:

Clients

Beacon Economics contributes to the understanding of economic development issues in the state of California and local regional economies through a variety of outlets. The completion of contract research targeted to economic development issues is an important part of this work.

Current clients include:

The City of Oakland

The Port of Oakland

County of Los Angeles Workforce Investment Board

The Bay Area Council Economic Institute

Paulson & Company, Inc.

The Los Angeles Area Chamber of Commerce

Resolve Capital

California Forward

Clear Capital

And this is to whom Chris Thornberg has loyalty:

In December 2007, he was appointed to California State Controller John Chiang’s Council of Economic Advisors – the body that advises the state’s chief fiscal officer about critical economic issues facing California.

In other words, the Times forgot to tell you that it ended this sorry piece of "journalism" by quoting a highly interested party.

If this is at all typical of what goes on at the Times, it's time for it to fail.

On the other hand, I am more bullish on California than I have been in a long time. It reminds me of New York City in 1975: nowhere to go but up-or so we can hope.

Copyright (C) Long Lake LLC 2009

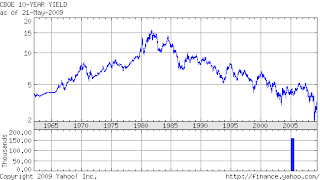

Bonding

The above graphs show the trend of Government bond rates (left scale) since1962 and1977 for the 10-year and 30-year bonds, respectively.

For a number of reasons discussed below, both investors and speculators can now have a reasonably safe short-term and perhaps intermediate-term (or longer) investment opportunity in 10-30 year duration Government bonds. Here are some of the reasons.

1. Sentiment

A recent poll of "Big Money" showed that less than 5% of responders were bullish on T-bonds. Since that poll was published recently, the price of these securities has fallen drastically. Probably very few people you know have much if any of their own personal money invested in intermediate to long bonds, as everyone "knows" that they are in a bubble.

2. Technicals

As the above charts show, yields are in a steady multi-year, multi-decade downtrend. As we saw in houses recently, NASDAQ stocks in the late 1990s, and precious metals in the late 1970s, megatrends such as this often go to wild excess and become popularly known as "can't miss" investments before they peak. The sharp drop in yields after the panic of the late summer and fall last year has been completely reversed, and there was no serious popular talk at that time of a "new era" that said that one should buy a 30-year bond to hold it, because rates were fated to go Japanese and drop much lower.

On a short-term basis the ten-year's yield has jumped about 70% in just 5 months, from about 2% to about 3.4%. The 30-year's yield has jumped even more, about 75%, from about 2.5% to about 4.4%.

Both are within the trading ranges of the 2001-2003 bull market for these securities, providing real support.

Seasonally, Treasuries tend to outperform starting around this time of the year.

3. Fundamentals

Here are some points favoring fundamentals of T-bond ownership:

- Price inflation is nonexistent, and is probably negative

- Therefore the real return at the moment for bonds is very high

- The absolute interest rate difference between 2 year T-notes and the 10 year is high at 2.6%

- The ratio of the 10/2 yields of 3.45%/0.88% of almost 4:1 may be a record

- David Rosenberg (ex-Merrill, now Gluskin Sheff) reports that the yield on the 10-year bond has, on a 60 year basis, never ever failed to bottom after the unemployment rate peaks

- The unemployment rate almost certainly has yet to peak

- Until roughly 1960, the interest rate on the long Government was always lower than the dividend rate on high quality stocks

- Stock dividends are not overall rising any time soon

- Stocks are nowhere near trough valuations despite the Depression

- Cash is trash, and the Fed has announced that it will stay trash indefinitely

- The cyclical bottoming of the economy that is expected within the next 9 months will countercyclically diminish the Federal deficit and thus diminish the tsunami of debt now being issued

- If the economy in fact performs much worse than expected, then corporate debt will go into the toilet along with the stock market, and there will be a piling into Government debt for safety, even if the real interest rate on that debt is zero

4. Other

There are hidden costs to owning stocks. These costs range from commissions to the time taken following the price Mr. Market assigns to the stocks to following the "fundamentals" of the security, to the costs of any investment advisories, etc. In contrast, one can hold a Treasury to maturity. If one wishes to sell, liquidity is unparalleled. Treasuries can be bought directly from the Government at Treasury Direct on line; through a broker; through mutual funds; or as a stock with ownership of different durations (TLT, IEF, or IEI ticker symbols).

Copyright (C) Long Lake LLC 2009

Thursday, May 21, 2009

Misoverestimated?

First, he had to dispatch his CIA director and (former Bill Clinton Chief of Staff) Leon Panetta to tell the most important Congressperson that not only was the CIA not lying, but she more or less was the liar.

Then, his own Party dissed him on closing Guantanamo prison, curtly telling him that he lacked a coherent plan to do so, and to come back when he had one.

Today, in the pleasantries before his speech about national security, he forgot the name of his Secretary of Defense. He thought that Robert Gates was instead the Microsoft Gates and called him William Gates.

He has gotten into a debate with the prior administration's Vice President, whose unpopularity ratings are declining, as are the former President's (positive first and second derivative of the prior administration's popularity, in other words).

In the economic/financial sphere, not so hot either:

- Gold is up about 11% since he took office

- The dollar's value against other (fiat) currencies is heading down, both the past week or two and since he took office

- The price of Treasury bonds is falling rapidly, increasing the cost of financing his deficits

- The Fed is downgrading its economic outlook

- The WaPo dumped on his Treasury Secretary just 3 days ago

- Alan Greenspan said yesterday the banks are still undercapitalized

- While the famous second derivative of the economy's downturn has improved (meaning things are worsening more slowly), the second derivative of the stock market's upmove has turned negative (meaning the chart looks more like rolling over than surging upwards lately).

This is the classic time for even a President with the mainstream media on his side to have the cheerleading give way to a more nuanced public image. Might we be so lucky as to have the WaPo follow its excoriation of Mr. Geithner with a similar trashing of PPIP?

Barack Obama may have been misoverestimated. So may have also been the strength of the large financial institutions and the economy as a whole.

Copyright (C) Long Lake LLC 2009

Still Bearish After All These Months

- Nouriel Roubini came out this week with an unusually lengthy and detailed defense of his bearishness. He did concede the possibility of some up-moves in GDP, but glossed over that possibility as being due to inventory restocking and stimulus (if they occur). Over the medium term, he remains convinced that there are so many headwinds that we need to expect sluggish growth for several years to come, even when negative growth end.

- David Rosenberg, now with Gluskin Sheff in Canada, continues to make a sensible bear case and specifically calls for A) a 20+% stock correction and B) much lower 10-year Treasury rates.

- The FOMC disclosed today a downward revision in its growth forecast for 2009 and 2010, an increase (toward consensus) in projected unemployment rates, and the potential for yet more money-printing to help the Treasury and its wards Fannie-Freddie out.

- Sir Alan Greenspan in quoted in Greenspan Says Banks Still Have a ‘Large’ Capital Requirement:

May 20 (Bloomberg) -- Former Federal Reserve Chairman Alan Greenspan signaled that the financial crisis has yet to end even as borrowing costs tumble, warning that U.S. banks must raise “large” amounts of money.

“There is still a very large unfunded capital requirement in the commercial banking system in the United States and that’s got to be funded,” Greenspan said in an interview today in Washington. He also said that “until the price of homes flattens out we still have a very serious potential mortgage crisis.”

DoctoRx here. Now he tells us! Where was he when Big Finance was raising all its money recently? We must remember that Greenspan chose Bernanke and is a flack for PIMCO, which obviously has quite an in with the Fed and Treasury. So I view Greenspan's pronouncements as the "bad cop" alter ego of Bernanke, who has to present the sugar-plum fairy point of view.

(I do however disagree with Sir Alan that a flattening out of home prices would mark the end of the mortgage crisis.)

The article goes on to say that:

Greenspan’s comments suggest he sees a bigger capital shortfall in the banking system than reflected in regulators’ stress tests on the 19 biggest U.S. lenders.

Again, I want to presume that Bernanke is speaking through Greenspan, in another criticism of Tim Geithner a la the WaPo article of Monday, but of course I have no proof of this supposition.

Now that tens of billions of dollars of stock in Big Finance shares have been sold at vastly higher prices than were available not long ago, there is no need to keep stock prices at this level. In fact, implementing PPIP as planned will require a statement of systemic emergency in order for the FDIC to prostitute itself for the benefit of Big Finance and Larry Summers' hedge fund friends, and so some withering shoots and withering stock prices would suit Big Finance just fine around now, I would suspect.

Time of course will tell, and the Establishment believes its time will never end and therefore has a very different time frame from that of traders. Econblog Review believes that in these manipulated markets, trading is what the Establishment wants you to do- because it brings in profit to the financial community- and therefore you should think in longer time frames than usual. Keep your friends close and your money closer.

Copyright (C) Long Lake LLC 2009

Wednesday, May 20, 2009

14 TRILLION . . . CALORIES

However, another estimate of the importance of 14 trillion is the number of calories Americans would need to shed in order to get to some semblance of normal weight.

This number can be estimated as follows. 300 M Americans X 15 lbs overweight (or more) X 3500 calories/pound gets one there, plus a little for good measure.

What does this number have to do with an economics post?

Think of the outperformance of McDonald's vs. Wal-Mart. McDonald's stock is the best performer of the Dow 30 over the past 24 months, having returned about 10% in that time frame. Wal-Mart sells what are arguably more necessary items than MCD, yet its stock price keeps eroding. Today, MCD got a lift because an analyst touted the rollout of its premium espresso/cappuccino line.

It would seem that despite a poor economy, Americans are more hooked on junk food and sugary coffee drinks than on the low-margined necessities that Wal-Mart sells.

Copyright (C) Long Lake LLC 2009

Kenneth Rogoff Thinks the 1970s Were Just Great

U.S. Needs More Inflation to Speed Recovery, Say Mankiw, Rogoff, he is reported on as follows:

“I’m advocating 6 percent inflation for at least a couple of years,” says Rogoff, 56, who’s now a professor at Harvard University. “It would ameliorate the debt bomb and help us work through the deleveraging process.”

In response, I am advocating that Dr. Rogoff take a leave of absence from professing and spend at least a month studying U. S. economic policy in the 1970s. Let us go through a brief exercise to point out some problems with his 6%+ solution.

First, let's understand that if his proposal became successfully-adopted policy, interest rates on all bonds will soar. This will create some of the following problems:

A. There will be a massive negative wealth effect among the holders of tens of trillions of dollars worth of bonds.

B. The U. S. Government will be revealed to have engaged in the most massive pump and dump scheme of modern times, having in recent years sold notes and bonds at rates well below the inflation rate it immediately adopted.

C. The stock market will plunge just as it did in the 1973-80 time frame, or in real terms from its real peak in 1965 to its perhaps 80% inflation-adjusted nadir in August 1982.

D. The idea of saving rather than borrowing will be destroyed for at least another generation. he borrower, after all, enjoys the fruits of the borrowed money while the lender, who earned the money he lent but forewent consumption (i.e., the enjoyment of his earning/saving) can be stiffed either by failing to repaid the principal at all or by being repaid with grossly devalued dollars.

E. It's hard to think of a significant engineered inflation in which real standards of living do not fall, as price increases outpace wage and interest income.

F. Who will be able to finance anything with debt when it become prohibitively expensive?

G. Why will house construction not sink into another depression, assuming it comes out of the current one?

H. Etc.; think of your own criticisms.

A few months ago, Nouriel Roubini was criticized on this blog for advocating a "command and control" economy. Since that time, his predictions have been less accurate than before. Dr. Rogoff may simply be freaking out too late, just as Dr. Roubini. The Government and the Fed (now basically one and the same) are pursuing the most inflationary policies since Jimmy Carter's time. Isn't that enough for the good doctor? Apparently not . . .

Forget A-E above. The more people hear a soft-spoken Harvard economics expert advocate nearly double-digit inflation to bail out borrowers at the short-term expense of savers, the more people with capital will refuse to lend at "reasonable" rates and the more speculative people will get.

We need a bridge to the next decade, not one to the 1970s.

Copyright (C) Long Lake LLC 2009

Tuesday, May 19, 2009

Cash is Trash When You Can Make 8% in One Day As Your Company Lowers Its Sales Guidance

In keeping with the times, readers will not be surprised to learn that about 16 years of interest on 2-year Treasury bills were "earned" in one day by holders of Lowe's stock, which rose 8% in one day.

Markets are moving divorced from fundamentals.

To demonstrate how hard it is to predict the future, Zero Hedge reported Monday in The Japanese don't think the crisis is THAT bad that at least for the past 27 years, consumer confidence in Japan has been virtually continuously below the neutral 50 mark.

What we know about the present is that in order for PPIP to be implemented, the Government must certify that an emergency exists to allow the FDIC to backstop the giveaways to the hedge funds. The markets are acting as if there is no emergency. Yet the Federal Reserve, which is either a public institution when it is convenient to be that and a private institution when that is convenient, and which for some reason has been granted the right to print Federal Reserve notes that are used as "money", is printing money to help finance the Federal debt and the mortgage markets, while Federal revenues plummet and Federal expenditures skyrocket.

On a mark-to-market basis, what is the Fed's net worth? How leveraged is it?

We may not want to learn this answer that the Fed will in any case not willingly tell us.

Copyright (C) Long Lake LLC 2009

Monday, May 18, 2009

Knives Coming Out for Geithner (and Obama Gets a Scrape) as PPIP Delay is Quietly Announced

Announced in early February, it (PPIP) may not launch until July, officials say.

Here are some of the specific criticisms, some of which are body blows:

But some of the officials also cite the Treasury's ad-hoc management, which is dominated by a small band of Geithner's counselors who coordinate rescue initiatives but lack formal authority to make decisions. Heavy involvement by the White House in Treasury affairs has further muddied the picture of who is responsible for key issues, the officials add.

I list this first because the second sentence above is an indirect but specific criticism of the Obama style of micromanagement. Comparison to Jimmy Carter is obvious. More on Geithner:

In March, Treasury officials clashed over a $15 billion initiative to use money from the federal bailout package to free up credit for small businesses. Geithner's counselors pressed to announce the program quickly, despite protests from the career staff members who said it would not work. Unable to raise the issue with Geithner himself, the staff members appealed directly to the White House but were rebuffed, according to sources familiar with the episode.

President Obama announced the program two months ago, and it is still struggling to get off the ground. Officials are looking to overhaul the proposal.

The Post goes on to criticize Geithner for micromanagement which is also ineffective:

And in the wake of the public firestorm over bonuses paid by American International Group, senior Treasury officials have been meeting several times a week all spring to review, one by one, the payments to the company's executives. But the time-consuming discussions have never resolved whether any of the executives should get paid.

Extraordinary. These guys are wasting their time reviewing individual bonuses- and not even making decisions?

More:

Still, some lawmakers and government officials said Geithner needs to be a stronger manager.

"No one knows how to get decisions made," said a senior government official familiar with the Treasury's inner workings.

The Post resumes the themes of White House micromanagement and related neutering of Geithner:

. . . the difference between the Treasury of former secretary Henry M. Paulson Jr. and Geithner's has been stark. Under Paulson, the department nearly always made its own decisions. The Bush White House, nearing the end of its tenure, hardly intervened.

But now, even minor matters, such as Web site design or news releases, are reviewed by the White House. Staff members detailed from the National Economic Council, reporting directly to Obama senior economist Lawrence H. Summers, roam the Treasury building. Treasury staff members working on restructuring the nation's automakers took much of their direction from the NEC, sources said.

Serious stuff when some at least implicit if not explicit comments favoring Bush/Paulson over Obama/Geithner make it into a WaPo article.

The article finishes with devastating comments about Geithner:

"People think he's very, very smart, but he has not exerted a management presence yet," added a source familiar with the Treasury's inner workings.

"He has not exerted a management presence yet." Wow. Finally:

"He's being stretched in a thousand directions . . . but I don't know if that absolves him of responsibility for management."

Yesterday, the Post, which is an unofficial house organ of the Democratic Party, wrapped the Pak-ghanistan War in the Flag, as commented upon here in Economy Due to Suffer as War Drums Beat More Loudly. The op-ed referred to therein was clearly a message from the White House. So, largely, was this article. Timothy Geithner is in over his head. This article strongly suggests that the powers-that-be in the administration are dissatisfied with his managerial competence.

Will Mr. Geithner declare victory over the financial crisis and move on to a lucrative job in Big Finance?

Copyright (C) Long Lake LLC 2009

Economy Due to Suffer as War Drums Beat More Loudly

No. Like it or not, it's America's war,

the Post channels the duo it once despised, reminding its readers:

There are forces in the world that continue to wage war against the United States and its allies, whether or not the United States wants to acknowledge that war. (Ed.: I thought the War on Terror was a bumper sticker slogan in the Post's world. Now it's a real war?)

Mr. Obama's recent decisions on paying for Afghanistan, reviving military tribunals and withholding photos of detainee abuse, among others, all reflect this reality. . .

His commitment to fighting al-Qaeda and its allies in Afghanistan and Pakistan recognizes that pretending a threat does not exist will only increase the danger to America.

So intent is the Establishment that sold America on Barack Obama as an agent of change that in almost no time it is back to supporting the same policies it hated when a white guy was in charge that it can blatantly lie:

Once before this country abandoned the battlefield in central Asia; Osama bin Laden moved into the vacuum. Today, he and like-minded terrorists continue to conspire in Pakistan, Afghanistan, Somalia, Yemen and elsewhere. (Emph. added in bold)

DoctoRx here. Presumably the central Asian nation the U. S. allegedly abandoned the battlefield of was Afghanistan, as Viet Nam is not usually considered a central Asian nation and Mr. bin Laden was a young child when JFK and LBJ were enmeshing us in that disaster. The obvious lie is that the U. S. was never a real combatant in Afghanistan, so there was no abandonment. Furthermore, Osama was our guy back then. Our client state Pakistan created the Taliban to fight the Soviets, remember? Further-furthermore, after the Soviets abandoned Afghanistan, the situation was so chaotic that is unclear what the U. S. was supposed to do there. Join in a civil war?

The language of this editorial would be expected from the National Review or the Weekly Standard. From WaPo, it's amazing. What about giving peace, and negotiations a chance? The tilt in Obama-land toward pro-war "realism" was further verified today in an op-ed by a lady named Salena Zito titled Anti-War Voices Lose Influence:

Will the last activist who hopes the antiwar cause will re-emerge as a central tenet of the Democratic Party please turn out the lights on the way out the door? . . .

While President Obama gingerly takes ownership of the war in Afghanistan - pumping up troop levels, hand-picking his own commander, adding Pakistan as part of the solution and the problem - he is disowning antiwar activists who voted for him, expecting him to put an end (to) all wars.

In the meantime, the blogosphere has been busily reprinting the "Chart of the Day" from a couple of days ago, showing that Q1 earnings for the S&P 500 were the lowest based on records from 1936 onward when adjusted for inflation, at $10, equating roughly to a 20X P/E, and a projected infinite P/E on a Q4 2008 through Q3 2009 basis, given the huge loss in Q4 2008.

The Merchants of Debt are merging with the Merchants of Death. Each needs a war. The Post editorial leaves little doubt that American "advisers" are soon to appear in Pakistan (likely they are there already) to tell them how to win (meaning perpetuate) this conflict.

The real economy in the U. S. needs to simply focus on reducing debt levels with a fair and open set of negotiations between those who lent unwisely and those who borrowed unwisely. What instead is happening is phony bank accounting, without which the reported $10 in S&P earnings might have been zero, creating zombie banks that will do what their new masters in Washington tell them to do. Contrary to the drumbeat of opinion from Big Finance and its hucksters, more borrowing and lending is NOT what is needed. There is no time like a Depression to save and then use the compounding power of saving to build capital and thereby meet the needs of the country and its people, businesses, natural assets, etc.

For the nonce, industrial capacity is at its lowest percentage of capacity since the Great Depression. There is little legitimate need to borrow, as almost everything is in excess. Until the next Viet Nam occurs, Treasuries are a reasonable buy as deflation is actually here. Cash makes sense and gold makes sense given that the Establishment wants inflation and generally gets its way, though at what pace is uncertain.

As this blog has opined since its founding in December 2008, at higher Dow and S&P levels than today, the stock market remains for speculators rather than investors.

Copyright (C) Long Lake LLC 2009

Saturday, May 16, 2009

On Public Corruption and the Military-Financial Complex

I had heard from an authoritative source that Washington, D. C. had become more corrupt than ever, bipartisanly, at the end of the Clinton era. Now comes word that London is "there". From the Huffington Post, Britain's Expense Scandal Widens. Here are some snippets:

Labour lawmaker Shahid Malik stepped down as justice minister early Friday after data showed that he claimed more than 65,000 pounds ($98,000) in housing costs over three years despite having discounted rent.

Brown's aide on climate change, Elliot Morley, was also suspended after he billed taxpayers' 16,000 pounds ($24,000) for mortgage interest payments on a loan that had already been paid off. Morley says he's now paid the money back.

The latest revelation came late Friday with another Labour lawmaker claiming thousands of pounds (dollars) of taxpayer money for interest on a non-existent mortgage. David Chaytor said he would pay back 13,000 pounds ($18,000) after continuing to submit bills on his paid mortgage.

"In respect of mortgage interest payments, there has been an unforgivable error in my accounting procedures for which I apologize unreservedly," Chaytor said. "I will act immediately to ensure repayment."

For the Conservatives, lawmaker Andrew Mackay quit his post as an aide to party leader David Cameron after he said he'd been guilty of errors over his expenses claims. . .

Other scandals have rocked Britain's politician system in recent history _ British Cabinet minister John Profumo's liaison with a prostitute almost brought down the government after it was revealed the woman was also linked to a Soviet spy _ but few have shaken all main political parties. . .

"We need our own Barack Obama," said Francis O'Hara, 24, a student. "This country needs a change."

The entire article is worth a read. The only part of it with which I disagree is Ms. O'Hara's statement. For another HuffPo article demonstrating the continuity of the Obama administration with that of Bush II, consider the following article/opinion piece it published from

Graham E. Fuller ,Former CIA station chief in Kabul and author of The Future of Political Islam

Posted May 11, 2009 09:24 AM (EST):

Obama's Policies Making Situation Worse in Afghanistan and Pakistan.

Here is the start of the piece:

For all the talk of "smart power," President Obama is pressing down the same path of failure in Pakistan marked out by George Bush. The realities suggest need for drastic revision of U.S. strategic thinking.

-- Military force will not win the day in either Afghanistan or Pakistan; crises have only grown worse under the U.S. military footprint.

Please read the entire article. Absent another military conflict, the current Depression should lift and resolve itself into at least a "muddle-through" economy (John Mauldin's phrase). Continued/ramped-up war in Asia would guarantee rampant inflation and a continued decline in living standards in America- though Gross Domestic Product will rise! (As this policy would entail and require more governmental debt, look for it to become more and more likely as domestic uses of debt are largely tapped out.) For a detailed look at different points of view of America, Pakistan, and their relationship, consider the following blog run by "Fabius Maximus", which provides a wealth of articles and opinion pieces on this topic: Why are We Fighting in Pakistan?

No, Ms. O'Hara. Britain does not need its own Barack Obama. As does America, it needs change it really can believe in. Changing the Bush policy on family planning and generating some headlines about closing Guantanamo are not change. They are diversions to allow the permanent Establishment. The money is in Big Finance: No change there, except for the worse (PPIP). The money is in fighting and inciting wars: No change there, except for a more aggressive Obama policy in Pakistan.