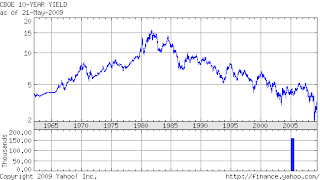

The above graphs show the trend of Government bond rates (left scale) since1962 and1977 for the 10-year and 30-year bonds, respectively.

For a number of reasons discussed below, both investors and speculators can now have a reasonably safe short-term and perhaps intermediate-term (or longer) investment opportunity in 10-30 year duration Government bonds. Here are some of the reasons.

1. Sentiment

A recent poll of "Big Money" showed that less than 5% of responders were bullish on T-bonds. Since that poll was published recently, the price of these securities has fallen drastically. Probably very few people you know have much if any of their own personal money invested in intermediate to long bonds, as everyone "knows" that they are in a bubble.

2. Technicals

As the above charts show, yields are in a steady multi-year, multi-decade downtrend. As we saw in houses recently, NASDAQ stocks in the late 1990s, and precious metals in the late 1970s, megatrends such as this often go to wild excess and become popularly known as "can't miss" investments before they peak. The sharp drop in yields after the panic of the late summer and fall last year has been completely reversed, and there was no serious popular talk at that time of a "new era" that said that one should buy a 30-year bond to hold it, because rates were fated to go Japanese and drop much lower.

On a short-term basis the ten-year's yield has jumped about 70% in just 5 months, from about 2% to about 3.4%. The 30-year's yield has jumped even more, about 75%, from about 2.5% to about 4.4%.

Both are within the trading ranges of the 2001-2003 bull market for these securities, providing real support.

Seasonally, Treasuries tend to outperform starting around this time of the year.

3. Fundamentals

Here are some points favoring fundamentals of T-bond ownership:

- Price inflation is nonexistent, and is probably negative

- Therefore the real return at the moment for bonds is very high

- The absolute interest rate difference between 2 year T-notes and the 10 year is high at 2.6%

- The ratio of the 10/2 yields of 3.45%/0.88% of almost 4:1 may be a record

- David Rosenberg (ex-Merrill, now Gluskin Sheff) reports that the yield on the 10-year bond has, on a 60 year basis, never ever failed to bottom after the unemployment rate peaks

- The unemployment rate almost certainly has yet to peak

- Until roughly 1960, the interest rate on the long Government was always lower than the dividend rate on high quality stocks

- Stock dividends are not overall rising any time soon

- Stocks are nowhere near trough valuations despite the Depression

- Cash is trash, and the Fed has announced that it will stay trash indefinitely

- The cyclical bottoming of the economy that is expected within the next 9 months will countercyclically diminish the Federal deficit and thus diminish the tsunami of debt now being issued

- If the economy in fact performs much worse than expected, then corporate debt will go into the toilet along with the stock market, and there will be a piling into Government debt for safety, even if the real interest rate on that debt is zero

4. Other

There are hidden costs to owning stocks. These costs range from commissions to the time taken following the price Mr. Market assigns to the stocks to following the "fundamentals" of the security, to the costs of any investment advisories, etc. In contrast, one can hold a Treasury to maturity. If one wishes to sell, liquidity is unparalleled. Treasuries can be bought directly from the Government at Treasury Direct on line; through a broker; through mutual funds; or as a stock with ownership of different durations (TLT, IEF, or IEI ticker symbols).

Copyright (C) Long Lake LLC 2009

No comments:

Post a Comment